Rent Vs. Buying

The common question we always get is “When is the right time to look for a home?”

To be honest, multiple factors play a role in this question, such as savings, credit, income, job stability, purchase price, and job experience.

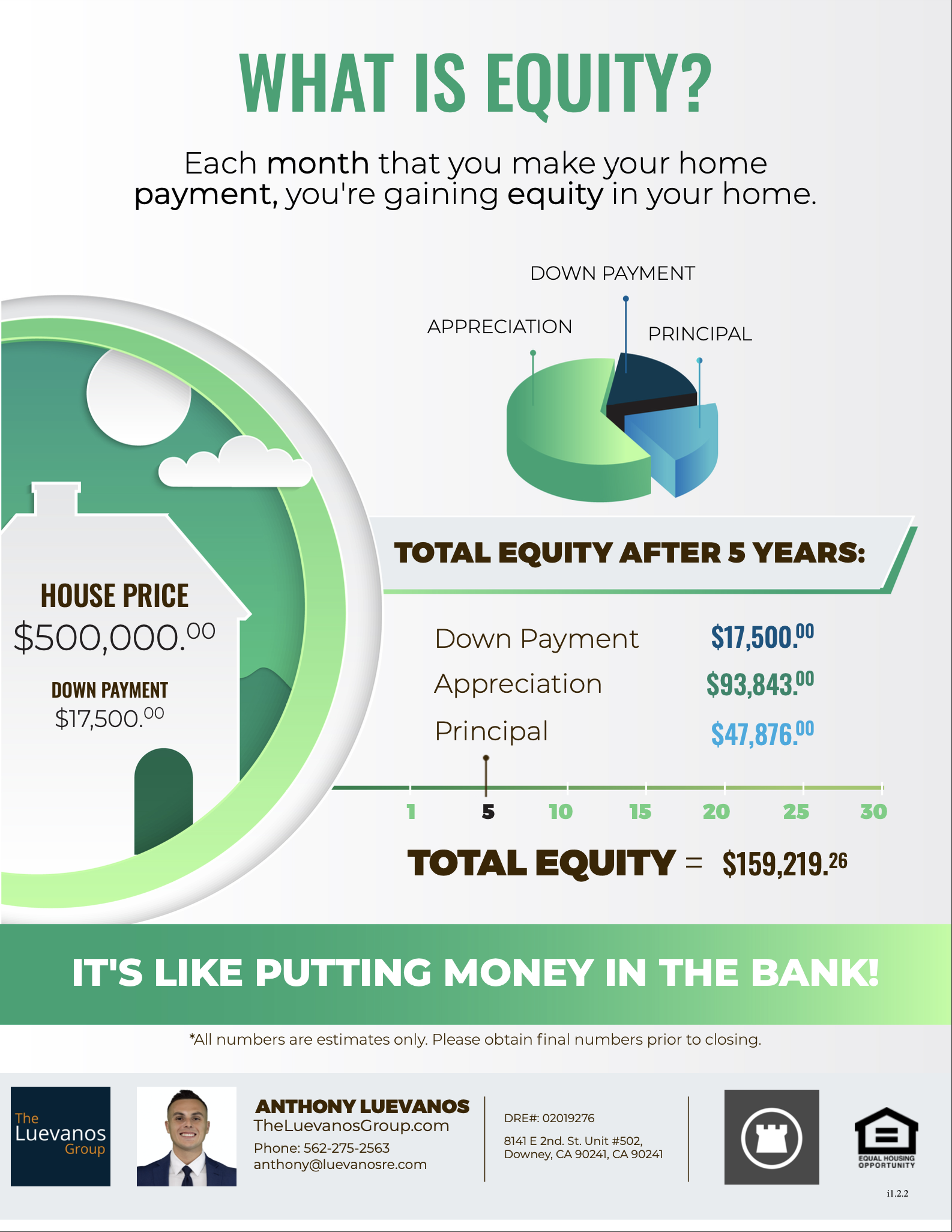

With that being said, we always recommend considering buying a home as soon as you are ready because of the tax breaks, equity, and stability you will gain owning your own home.

Here’s a breakdown of a couple of scenarios:

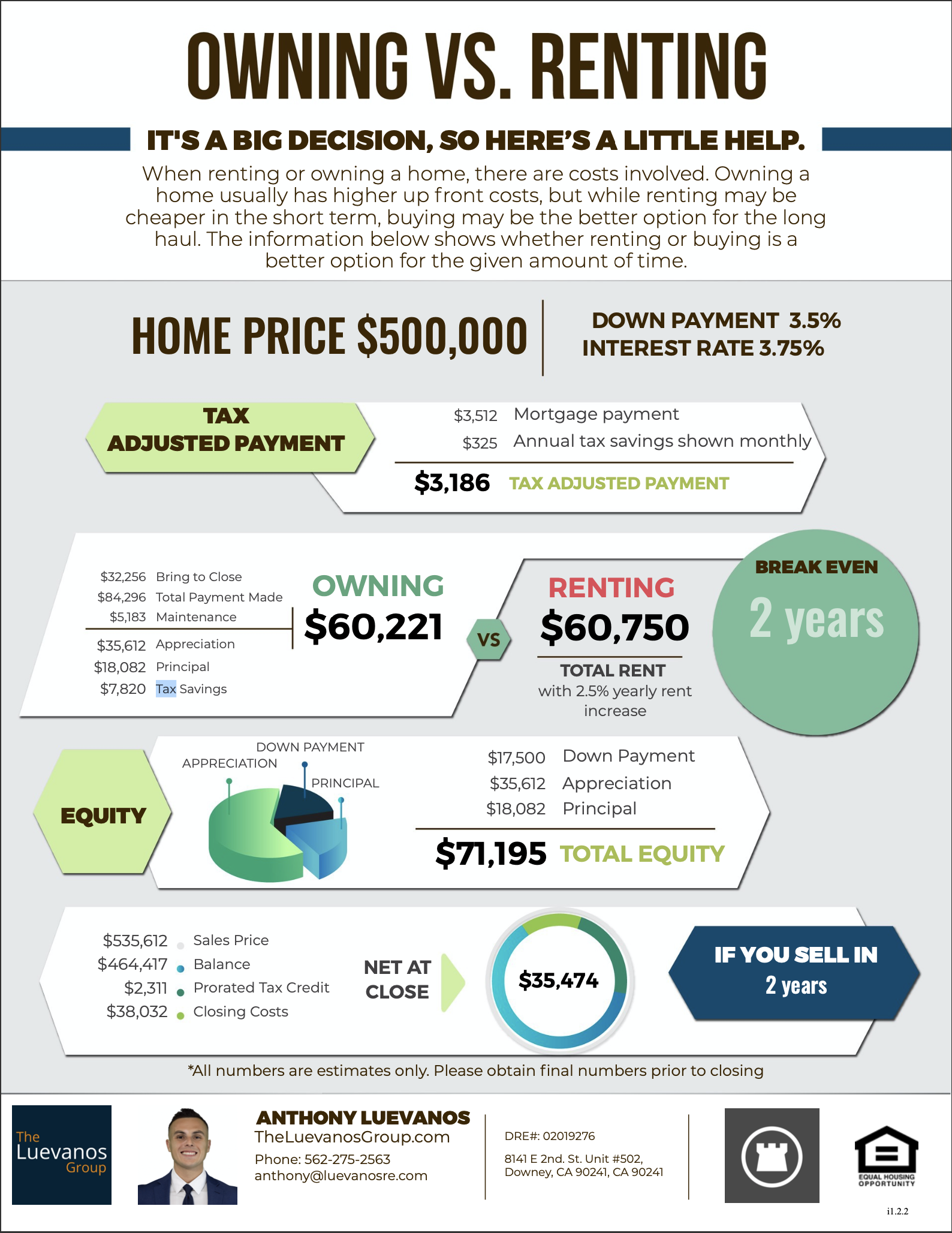

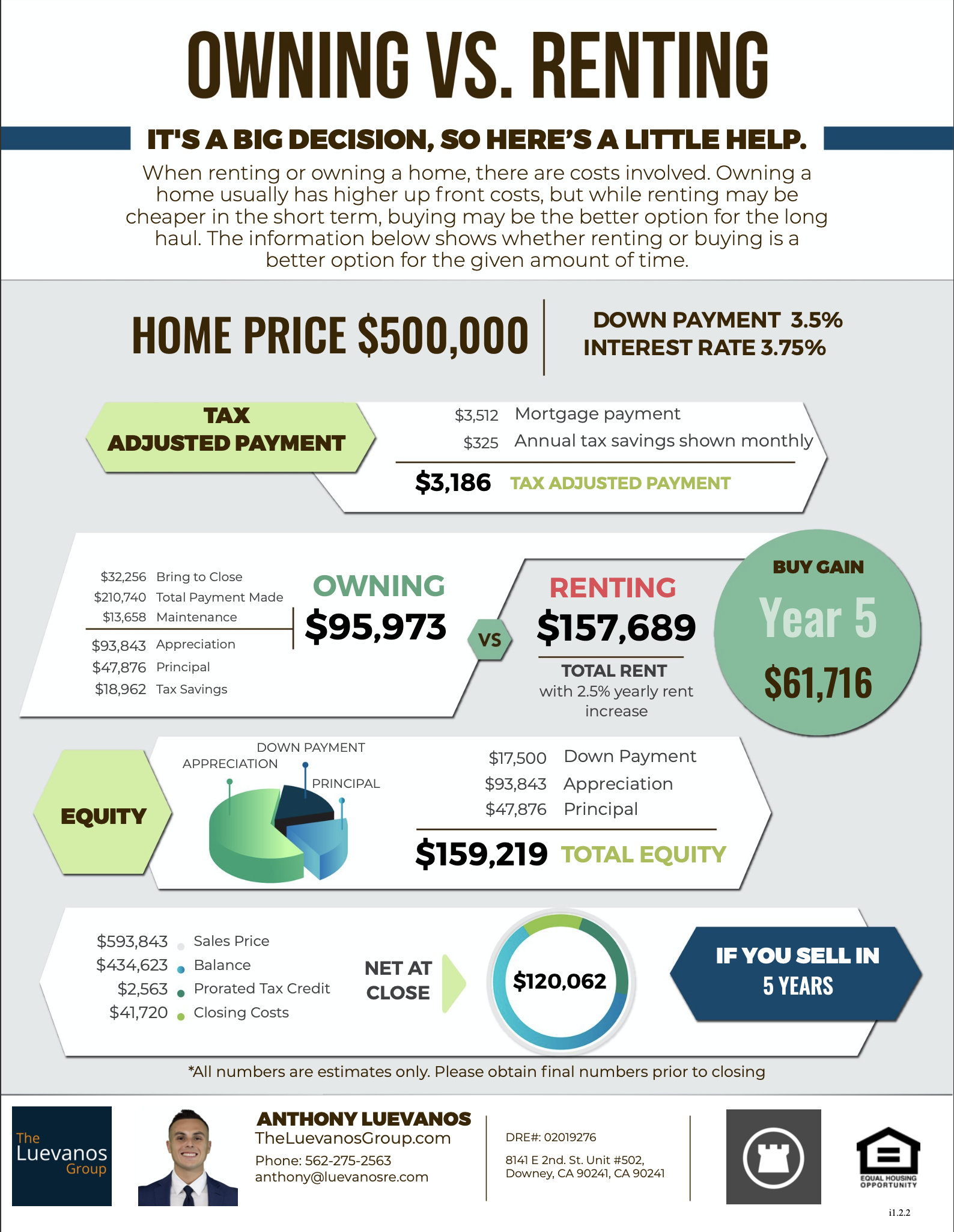

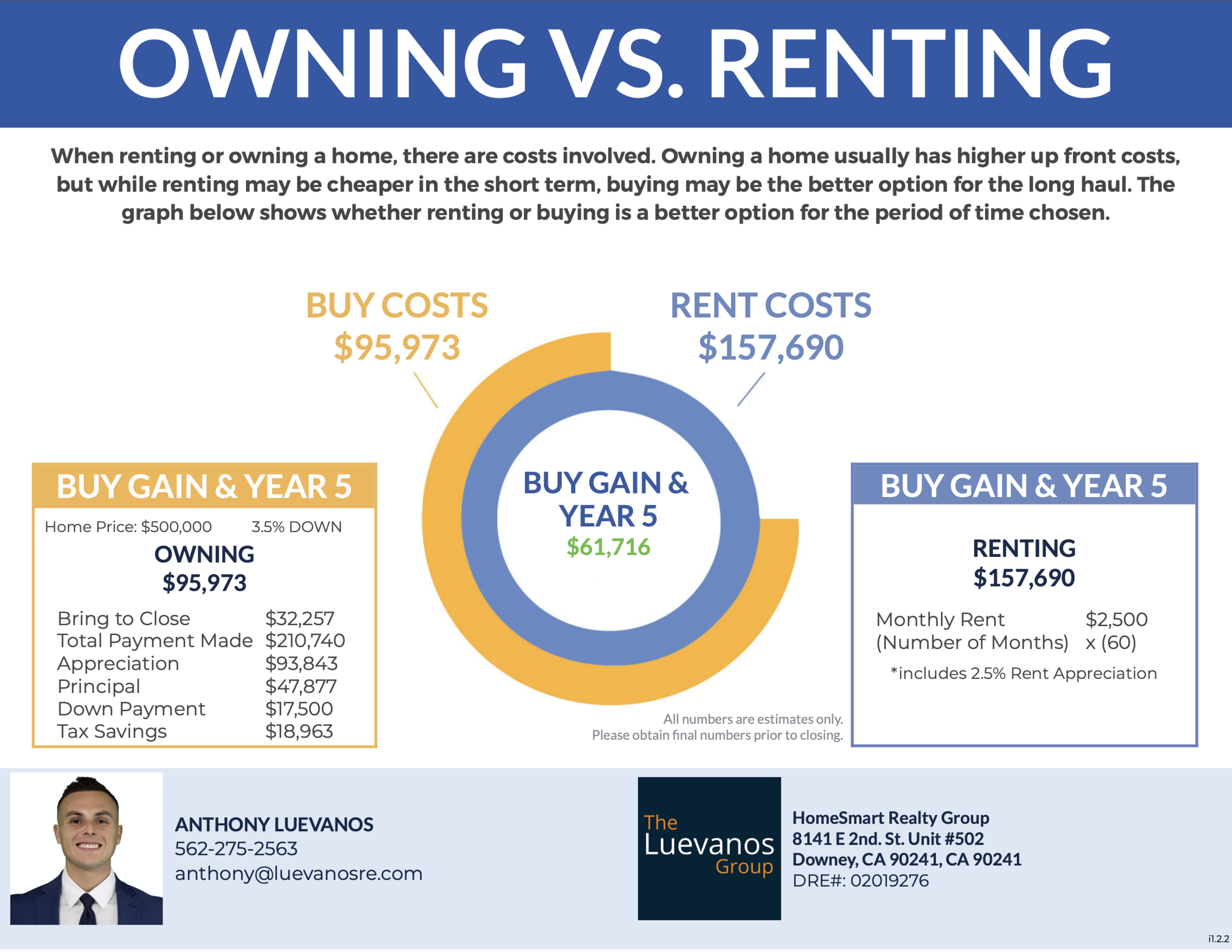

Scenario #1

Rent is $2500 monthly and looking to buy a $500,0000 home with a FHA at 3.5% downpayment

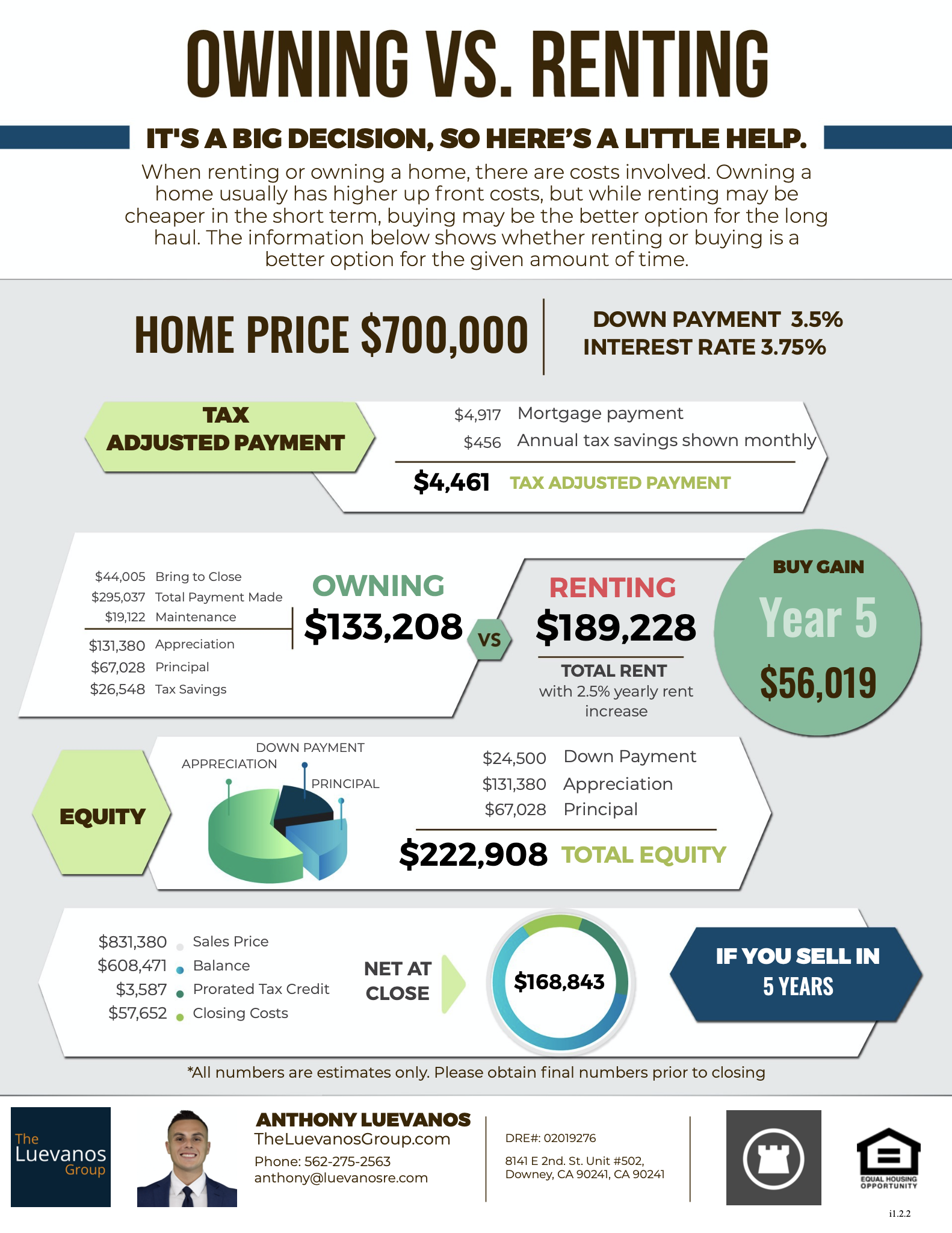

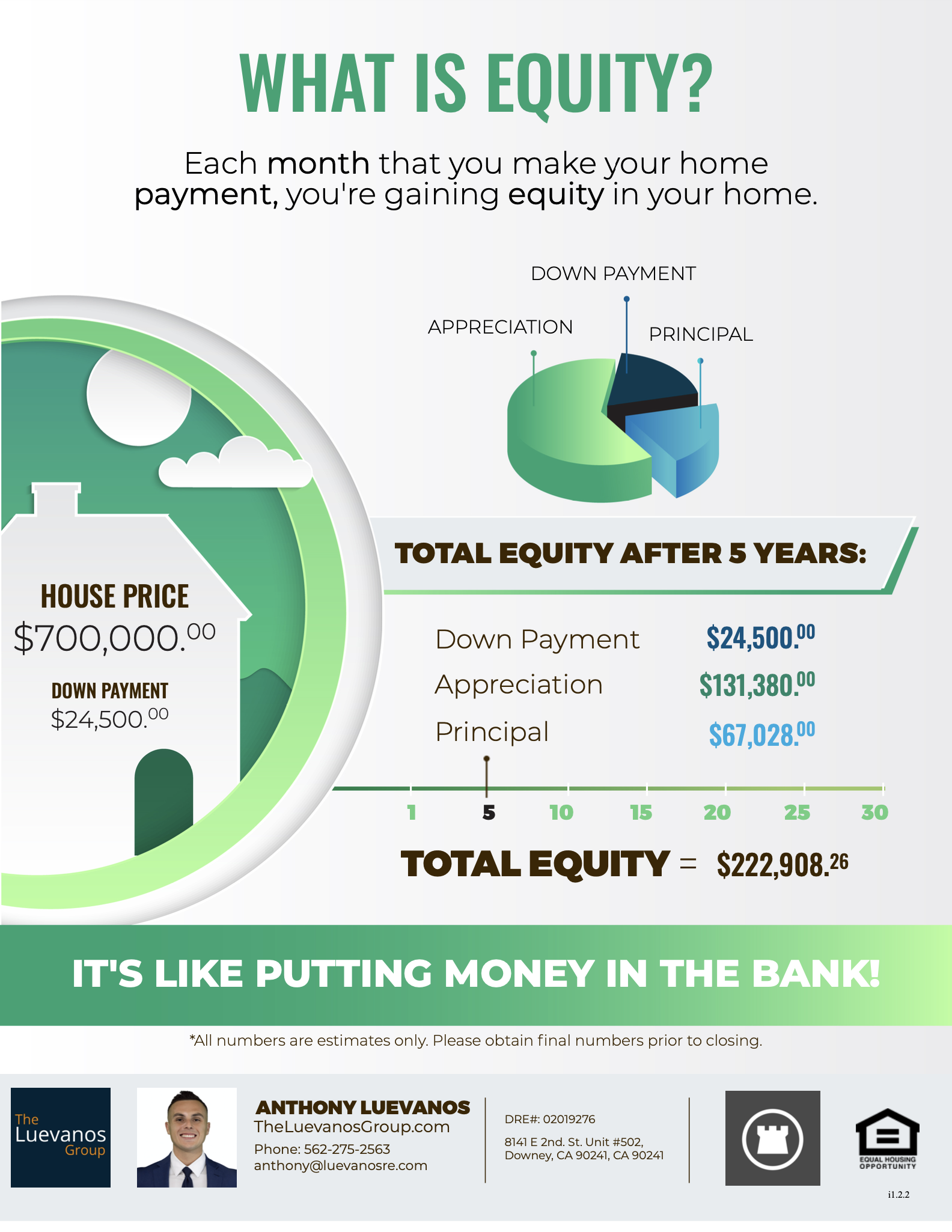

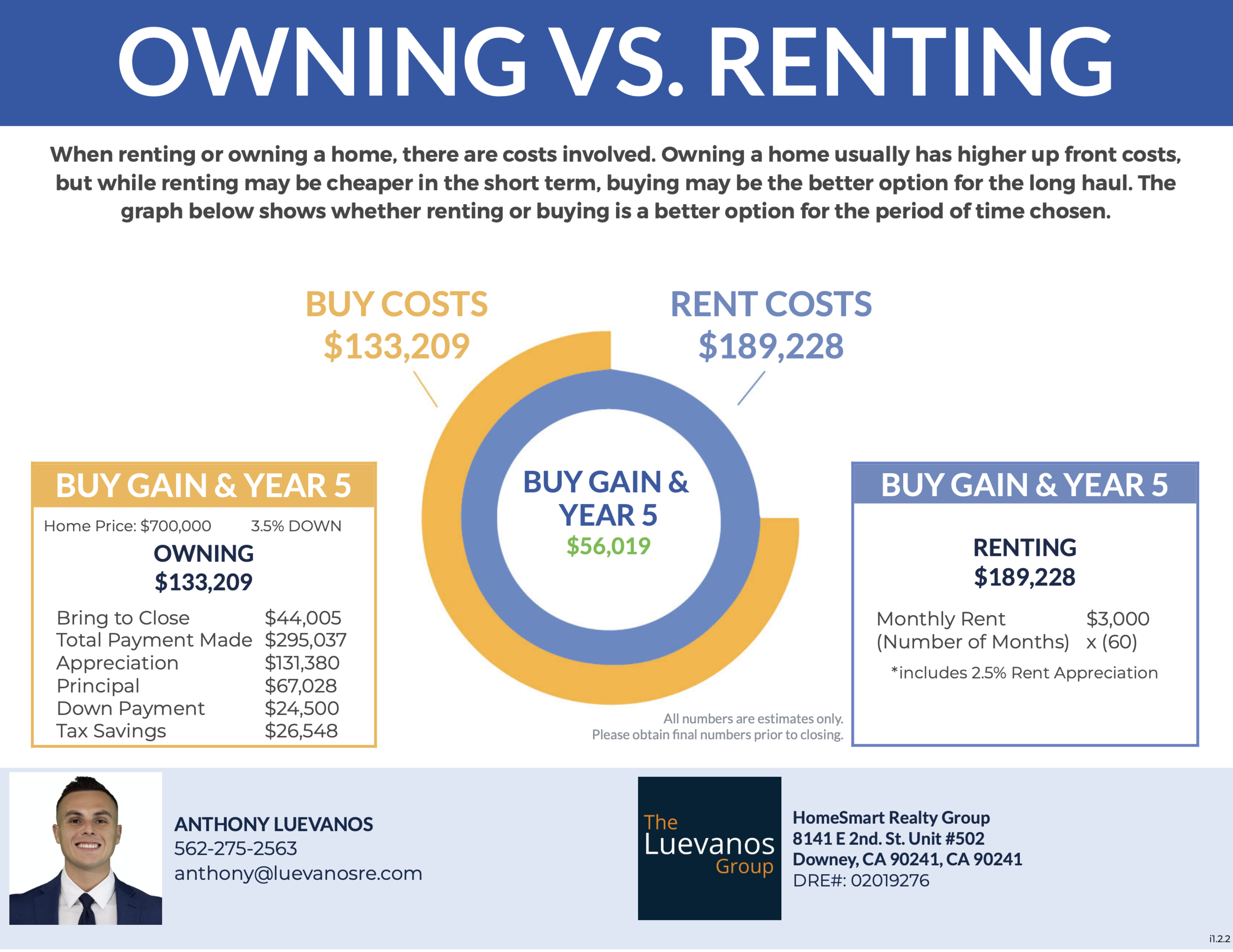

Scenario #2

Rent is $3000 monthly and looking to buy a $700,000 home with an FHA Loan and a 3.5% downpayment

Break-even in this scenario is 3 years

Wondering what your rent and home price break even point is? Enter your information below and I will email or text you a full custom report.